It’s no question that crypto exchanges (especially those catering to alt coins) come and go with the times. From the downfall of Mt. Gox to the fast and meteoric uprising of Binance, it can be hard to get a handle on whom to trust with your hard-earned coins, tokens, and fiat in this unregulated industry. It seems that a new and happening crypto exchange pops up every month, creating a vast amount of options, many of which are not worth your time, trust, or money. With that in mind, we at Bitcolumnist have compiled a list of vetted exchanges with a few different, but all so important, indicators of success. That said, before we kick things off, let’s start with some background information for the uninformed — feel free to skip ahead using the Table of Contents if needed, happy trading.

Table of Contents

Define Alt Coin Exchange

A cryptocurrency exchange AKA a digital currency exchange (DCE), provides an Internet-based system for the purchase or trade of a cryptocurrency or alt coins. While they operate on the same principles as fiat, commodities, or stock exchanges, alt coin exchanges specialize in the transfer of blockchain-based digital assets. Their users buy, sell, trade, and track cryptocurrencies on these financial exchanges. Like most other exchanges of assets, investors can create either limit or market orders. Some even allow for shorting specific currencies. Just like most financial brokerages, the process at a well-adjusted alt coin exchange works similarly, with minimal transaction fees and quickly filled orders.

Alt Coin Buying Process in 8 Quick Steps

Buying alt coins might seem to be like a maze for the uninformed. However, unlike the early days of cryptocurrency, buying alt coins in 2021 is a much easier and streamlined process than in the past. You no longer need to send your money to a sketchy PayPal account to buy your first Bitcoin to facilitate the rest of your transactions.

Another facet to take into account is determining which of the alt coins to sink your cash into. To name a few of the more popular options:

In addition to these well-known alt coins, there are also those alt coins lovingly referred to as “shitcoins“. Tread lightly when dealing with these not as well known coins.

Keep your crypto safe!

Due to the possibility of hacks or crypto exchanges going belly up, it is generally not a good idea to keep your coins/tokens directly on an exchange. We highly encourage you to either offload your crypto onto either a software or preferably a hardware wallet.

Remember it is the best practice to store all currency offline. Don’t become a victim.

Steps to Buy Alt Coins

Say we want to buy Monero. (If you are in the EU, you can skip to step 3)

- Get a Coinbase account, is an easy signup process, remember, due to KYC (know your customer) banking practices, you must provide some identification when doing so

- Buy Bitcoin (or Ethereum) with your newly verified coinbase account with one of the following funding methods:

- Credit Cards

- Debit Cards

- Direct Bank Transfers

- Find an exchange that supports Monero. Preferably this exchange has a good amount of trading volume.

- As an example, Binance supports XMR (Monero)

- Create an account on this exchange — if you skipped straight to step 3, additionally fund your account with one of their supported funding methods

- If you are coming from Coinbase, locate the wallet deposit page for BTC

- Find the deposit address, double-check to copy this correctly!

- Send your BTC from Coinbase to the exchange using this address, and wait up to 30 minutes for the transaction to clear, this all depends on the current exchange volume for this trading pair

- Once your BTC deposit has been confirmed, you can purchase XMR, or any coin you desire that is on this exchange.

- Navigate to the markets page. Search for the XMR/BTC trading pair

- Buy your alt coin using a Market order (or limit if you know what you are doing)

- Once your transaction has cleared (it should quickly on a high volume exchange) we highly recommend that you immediately move the XMR to your hardware wallet for maximum security

Don’t Lose Your Crypto in 3 Easy Steps

- ALWAYS Enable All Multi-Factor Auth on all exchanges you take part in — in many case 2-factor auth (2FA) is theoretically fine, but for the most secure experience, enabling as many factors as possible is preferred

- ALWAYS Test Your Withdrawaling Ability With a Small Amount First – After buying your cryptocurrency, test a small withdrawal onto your hardware or software wallet. If you copied down your keys correctly everything should go work seamlessly. Transferring your coin to the wrong address means that you lost it. Don’t ever do this. Triple check those copy and pastes! It is worth noting that if you want to “daytrade” your crypto, keeping it on the wallet will slow your roll.

- ALWAYS Keep your cryptocurrency offline (hardware or software) if you are going to be touching it for a while — ‘Nuff said.

Factors Indicating a Healthy Crypto Exchange

- A large and diverse sampling of coins and tokens

- We only want you to trade where you will have options to follow the latest and greatest coins

- Enough trading volume to matter

- Without other people executing cryptocurrency trades, your orders for alt coins will live in purgatory until you cancel them

- A history of transparency

- You must be able to see the information coming out of these exchanges, you don’t want them to out of the blue sunset a coin you’ve had your eye on

- Trusted by the pros

- Follow the cryptocurrency influencers you can trust and see what they have to say on each exchange, the wisdom of yesterday might not be true today. Needless to say, things change rapidly in this industry

- Lastly, we ourselves at Bitcolumist would trust our own monies in their coffers

Our Favorite Alt Coin Exchanges

Pro Tip: Not all cryptocurrency exchanges operate in all geographic locations. If your country is not supported for a specific exchange there is no other option than to use a VPN (@TY AFFLIATE LINK HERE) to get around these geographic restrictions.

Binance: The World’s Largest Crypto Exchange

- Very well known in the world of crypto

- Binance spans an entire ecosystem of cryptocurrency with many alt coins available

- Largest Player in the game with:

- 2.0 Billion Average daily volume

- 1,400,000+ Transactions per second

- Over 100 currencies/alt coins supported

Kucoin: Safe Cryptocurrency transactions start on KuCoin

- One of the world’s most impressive trading pair selections, with more than 300 trading pairs.

- Claims to have the most advanced API on the market

- Allows users to hold KuCoin Shares (KCS), i.e., its own cryptocurrency.

- If you hold of KCS, you receive cryptocurrency dividends on a daily basis.

- There are allow discounts in trading fees if you hold these shares

Kraken: Building the Internet of Money

- One of the largest and oldest cryptocurrency exchanges in the world

- Kraken is consistently named one of the best places to buy and sell crypto online,

- They’ve been on the forefront of the blockchain revolution since 2011

- Allows for margin trading and Staking

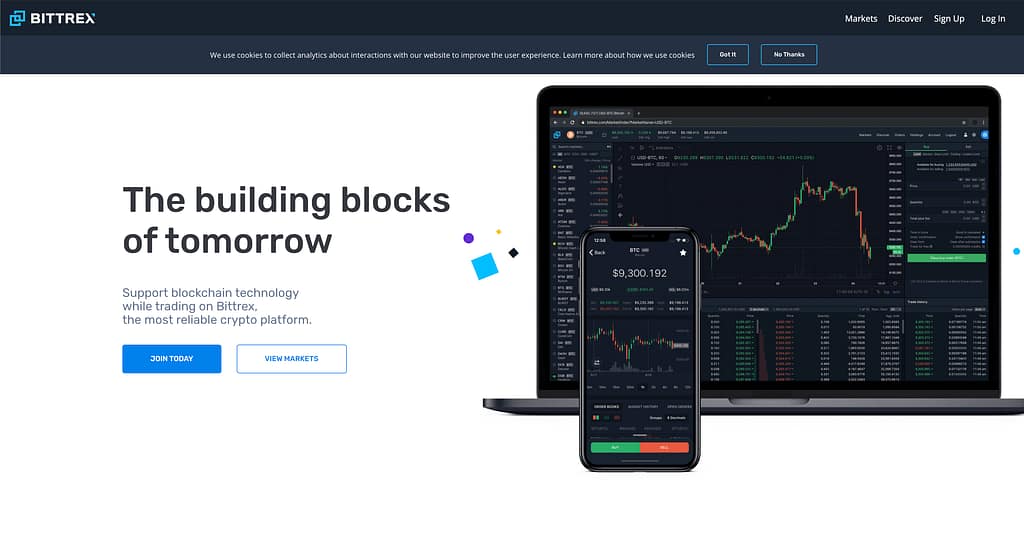

Bittrex: The Building Blocks of Tomorrow

- Slick Trading Platform

- Emphasizes their mobile apps

- Over 200 trading pairs, with many alt coins

- Founded in 2014 by three ex-Amazon employee

- One of the largest US-based crypto exchanges

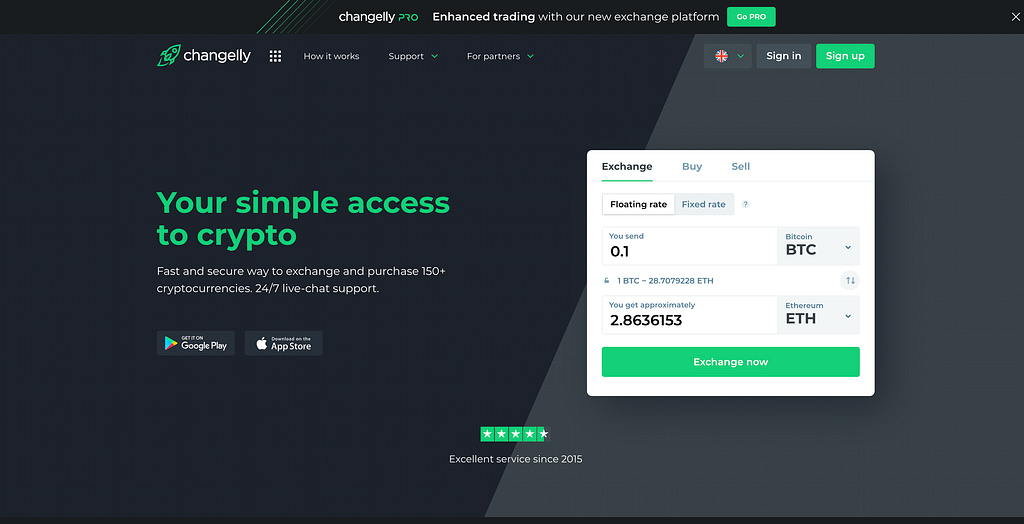

Changelly: Instant Trading Platform

- A conglomeration of crypto platforms

- Accepts direct from bank card transactions

- Integrated into the largest cryptocurrency exchange platforms, including Binance, Poloniex, Bittrex, etc.

- In the span of milliseconds, Changelly makes bids and asks on the platforms, then selects and suggests the best available rate

- Uses a fixed rate to take their cut, however, your trades will generally execute more quickly

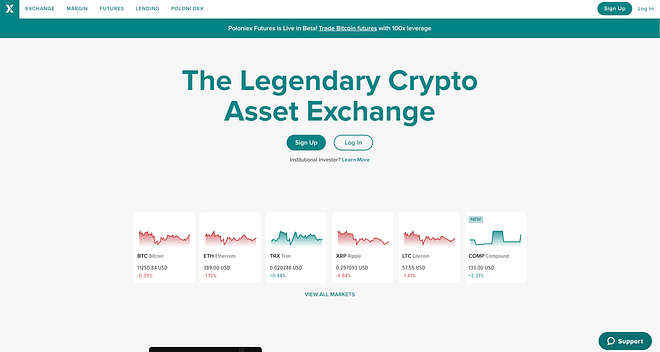

Poloniex: The Legendary Crypto Asset Exchange

- The lending-based crypto trading platform: “Let your crypto work for you”

- US-based trading platform

- More than 100 cryptocurrency pairs available

- Note: You cannot use this Exchange if you are a US Citizen

Bitmex: The Next Generation of Bitcoin Trading Products

- Bitcoin focussed, but worth a mention

- Advanced trading platform for experienced users

- $2.22B in 24h Volume

- Peer-to-Peer Trading Platform that offers leveraged contracts that are bought and sold in Bitcoin.

- Only handles Bitcoin. All profit and losses are in Bitcoin, even if you’re buying and selling alt coin contracts. BitMEX does not handle fiat currency.

- Allows trading with a high amount of leverage (100x).

- Note: You cannot use this Exchange if you are a US Citizen

Closing Thoughts on Buying Alt Coins

The best alt coin exchange for you will change based on the times and your trading style. Therefore, these are the factors you must consider:

- Where you live

- Your experience level

- Which alt coins you want to trade

- Your frequency of trading

- Whether you want to use a trading API (advanced strategy for programmers)

Wherever you end up choosing to trade crypto, that doesn’t mean it has to be the only place you do. There are many trustworthy exchanges out there. While they all compete with each other to have the most users/volume, most have fallen into their own little niche.