Searches for “Bitcoin Halving” on Google have reached extremely high levels. It indicates heightened public interest ahead of the upcoming event. According to Google Trends, the term has already hit a score of 45 and is projected to reach a perfect 100 by month’s end.

Quick Take:

- Google Trends shows record interest in “Bitcoin halving,” with searches expected to double compared to 2020.

- This halving round will cut the Bitcoin rewards for miners from 6.25 BTC to 3.125 BTC.

- The event has historically led to significant price increases for Bitcoin.

- The highest search interest comes from Nigeria, the Netherlands, Switzerland, and Cyprus.

The search for Bitcoin halving is expected to reach peak popularity in Google Trends. This surge in curiosity reflects more than double the interest seen during the last halving in 2020. It indicates growing awareness and anticipation around this much-awaited crypto event.

What is Bitcoin Halving?

Bitcoin halving is a significant event in the cryptocurrency world where the reward for mining Bitcoin transactions is halved. Therefore, reducing the rate at which new BTC tokens are created.

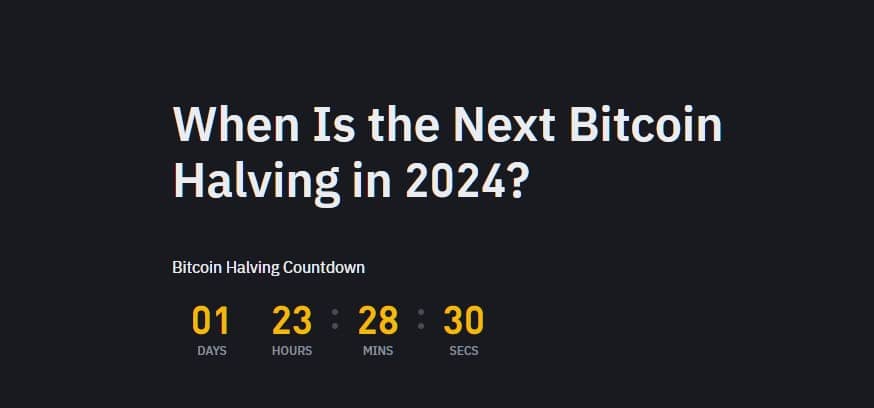

This year’s halving is set to decrease the mining reward from 6.25 BTC to 3.125 BTC and is expected to occur around 4 AM UTC on April 20. This event is essential for Bitcoin’s inflation control. Further, it will increase its scarcity, which could drive up its price as has been observed in the past.

As the halving nears, both seasoned investors and curious onlookers are closely watching the market. Traders are hoping to see a repeat of the dramatic price escalations witnessed earlier.

Expected Price Action of BTC Post Halving

Historically, Bitcoin has seen substantial price increases following previous halvings. After the 2012 halving, the price of Bitcoin rose by over 8,000% in the following year. Similar patterns were observed in 2016 and 2020 with substantial rises.

The halving mechanism is hardcoded into Bitcoin’s network to take place every four years. It ensures the digital currency’s supply remains under control and further cements its position as a store of value akin to gold.

Despite a recent dip in Bitcoin’s price from its all-time high of over $73,000, the long-term price outlook remains optimistic. Market analysts cite historical data to support potential price surges post-halving. Sevens Report analyst Tom Essaye sums it up as “Economics 101,” noting that if the demand remains stable while the supply decreases, prices are likely to climb.

As per Google’s search trends, the top countries showing keen interest in Bitcoin halving include Nigeria, the Netherlands, Switzerland, and Cyprus. Global attention to Bitcoin’s financial dynamics and future underscores its widespread appeal.