The cryptocurrency market witnessed a historic moment as Spot Bitcoin Exchange-Traded Funds (ETFs) hit a new all-time high with a staggering $676.8 million cumulative daily inflow. On February 28, BTC experienced this impressive influx and signaled a robust bullish trend.

Quick Take:

- Spot Bitcoin ETFs in the US reached an all-time high with a daily inflow of nearly $680 million.

- The iShares Bitcoin Trust leads the race with a historic inflow of $612.1 million.

- Bitcoin’s price momentum crosses the $63,000 mark, marking an increase in its trading volume.

- The global crypto sentiment is noticing a peak, with regions like Australia showing increased retail interest following the US’s ETF approvals.

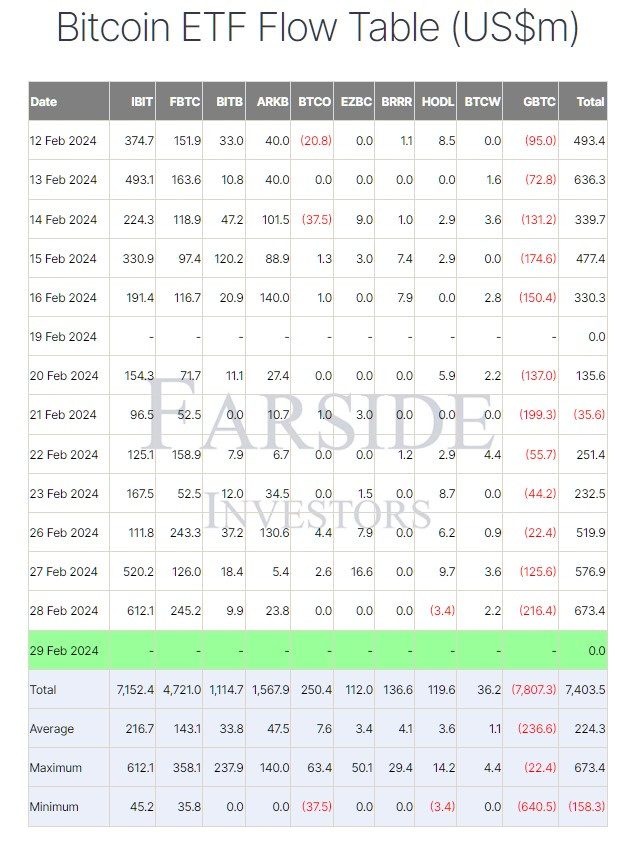

The iShares Bitcoin Trust led the charge with record-breaking daily inflows of $612.1 million, supported by other major players like the Fidelity Wise Origin Bitcoin Fund and the ARK 21Shares Bitcoin ETF.

The influx of retail and institutional investors proves that Bitcoin is gaining trust as a viable asset for investors. The iShares Bitcoin Trust (IBIT) broke its trading volume record with $3.2 billion. This figure surpasses the daily trade volume of most large-cap US stocks.

BlackRock’s IBIT saw a net inflow of over $7.15 billion and took its asset holdings above the $9 billion mark. The Fidelity Bitcoin ETF (FBTC) and the Ark 21Shares Bitcoin ETF (ARKB) also made significant strides, with inflows of $245.2 million and $23.8 million, respectively.

Some ETFs like GBTC have seen outflows despite the enthusiasm surrounding some ETFs. It shows investors have migrated to ETFs with more favorable fee structures and potential returns.

Is the Bitcoin Bull Run Here?

Bitcoin’s price trajectory has been spectacular in the past week. The leading cryptocurrency token is inching closer to the hyped $70,000 mark, just over its all-time high of $69,000. Its market cap has crossed the mark of $1.24T.

The token has also seen a surge in its trading volume while marking an uptick in futures and options open interest. Moreover, BTC’s price rally is backed by a solid increase in market participation.

The Crypto Fear & Greed Index is currently peaking at a 4-year high with a rating of 86. Thus, indicating a market sentiment deeply entrenched in “Extreme Greed.”

After the US approved Spot BTC ETFs, retail interest soared in regions like Australia. As a result of this cross-continental enthusiasm, Bitcoin is proving to be a currency that transcends borders and regulatory structures worldwide.

With institutional and retail investors rallying behind BTC, potential milestones and record-breaking achievements seem inevitable. Bitcoin’s resilience and its rapid price rise show its mainstream acceptance as an investment asset.