The crypto market has flourished recently amid growing anticipation around spot Bitcoin Exchange-Traded Funds (ETFs). As a result, crypto investment products have seen four straight weeks of inflows.

Quick Take:

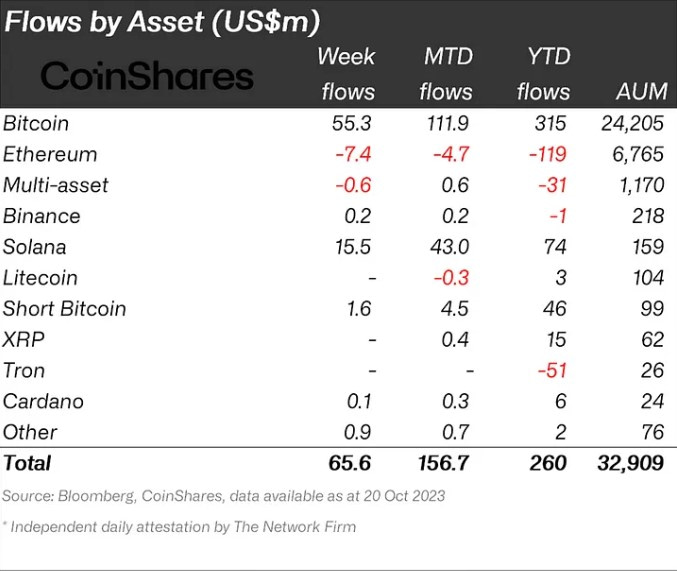

- Crypto investment assets saw an inflow of $66 million within the last week, Bitcoin makes up 84% of this figure.

- Ethereum notices outflow while Solana’s product leads the race among altcoins.

- Data reveals that the hype around the expected approval of spot Bitcoin ETF has boosted investors’ confidence.

- Europe notices the highest inflows while the United States marks outflows.

The report from an asset management firm, CoinShares shows that a staggering amount of $66 million was poured into digital asset investment products in the last week only, taking the four-week tally to $179 million. This has pushed the total assets under management in the crypto space to $33 billion.

These inflows are pretty much linked to the hype surrounding the approval of the spot Bitcoin ETF in the US. However, the inflows are on the lower side in comparison to June, when the announcements for the spot ETF were made by BlackRock. It shows that the investors have hopped in with a cautious strategy.

The Head of Research at CoinShares added,

“While the most recent inflows are likely linked to excitement over a spot Bitcoin ETF launch in the U.S., they are relatively low in comparison to the initial inflows following BlackRock’s announcement in June.”

A Breakdown of Net Inflows

In the inflows of the last week, 84% of the funds belonged to Bitcoin Investment Products. In total, Bitcoin investment asset product inflows have gone up to $315 million. On the other hand, Solana witnessed inflows of $15.5 million in the last week, taking its year-to-date inflows to $74 million.

The figures suggest that crypto short sellers are getting weaker with time. However, there are concerns over the performance of Ethereum products. It is the only altcoin to see outflows in the last week, as $7.4 million were spilled from the circuit.

Regarding inflows, Solana is currently the most popular altcoin in the crypto market. The stats of no other altcoin come close to Solana’s figures. Switzerland has shown the most interest amid inflows of $45.5 million. It is followed by Canada and France with $18.1 million and $10.9 million, respectively.

Crypto Investment Interest Grows Amid Spot Bitcoin ETF Rumors

The crypto market’s interest in the spot Bitcoin ETF is no hidden fact. The market is optimistic that the approval of these products is just a matter of time. Most recently, a US Court has ordered the SEC to review the Spot Bitcoin ETF filing of Grayscale.

As the news broke, the crypto market went berserk with Bitcoin crossing $34,500 and Ethereum approaching $1,900. Within a day only, the global crypto market cap has gone up to $1.28 trillion. Several altcoins have gained double-figure percentages over the past 24 hours.

With this price action, Bitcoin has crossed $34,000 for the first time since May 2022. It is a healthy development for the token and the overall crypto market which was trapped in a bear pattern for a long time. However, the surging rice has caused more than $193 million of Bitcoin short liquidations in the last day or so.